south carolina inheritance tax 2019

Note that in addition to estate taxes an estate in South Carolina may be subject to New York Inheritance Tax federal and South Carolina income taxes and other liabilities. 1 Decedent means a deceased person.

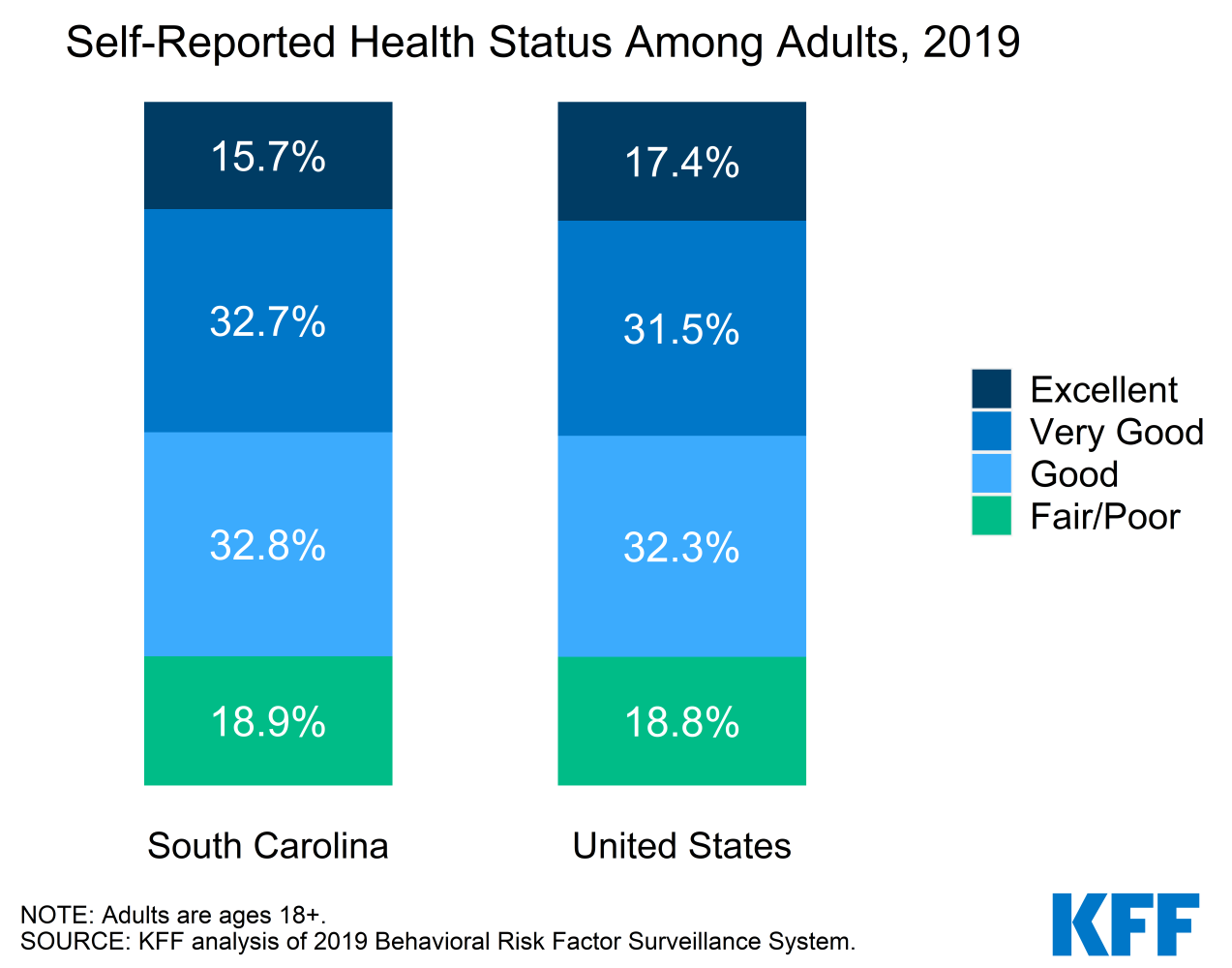

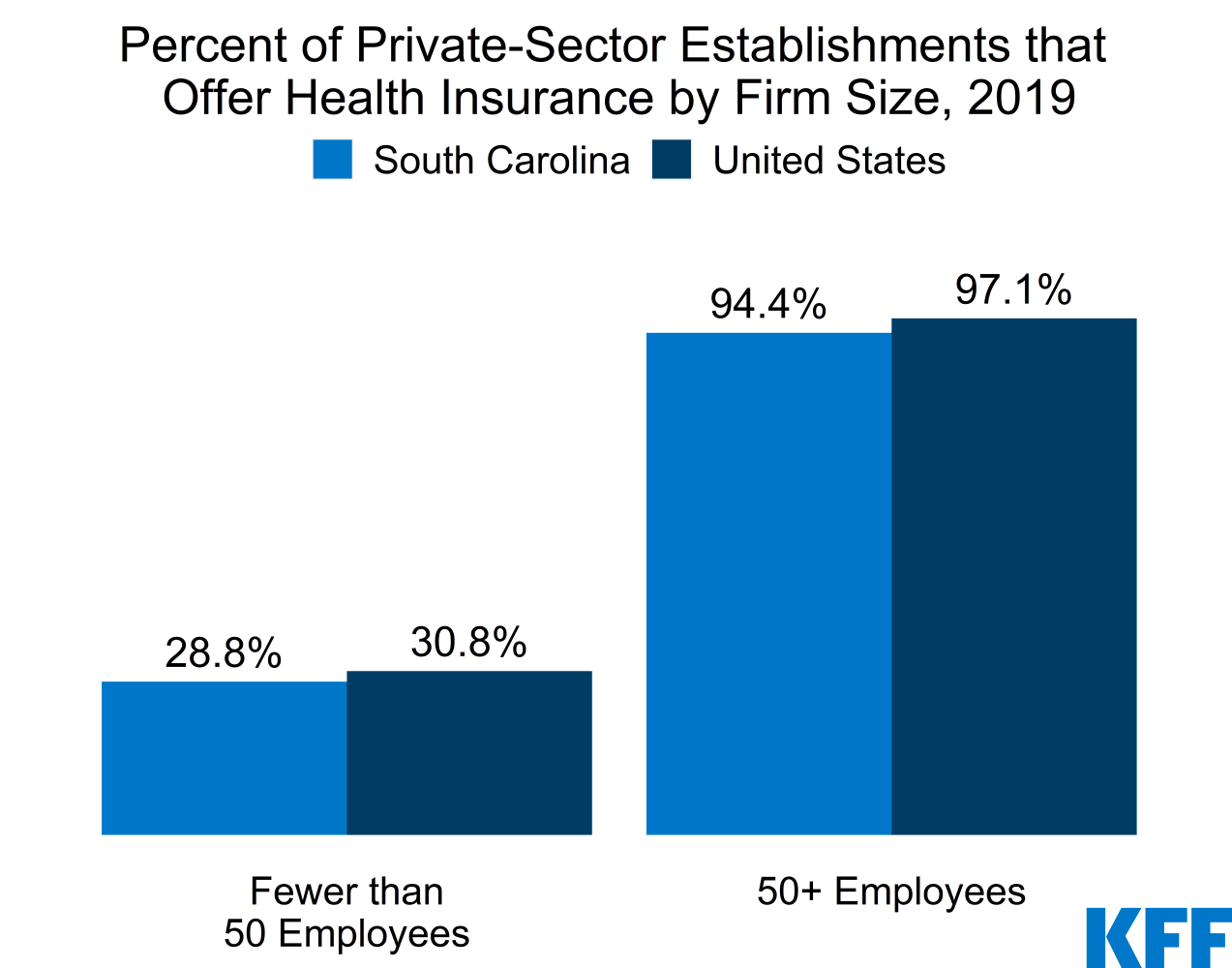

Election 2020 State Health Care Snapshots South Carolina Kff

South Carolina has no estate tax for decedents dying on or after January 1 2005.

. Section 62-2-103 1 states that any children inherit equal shares of the remaining estate. If an estate is worth 15 million 36 million is taxed at 40 percent. If the parents are deceased subsection 103 3 grants inheritance rights to the decedents siblings.

And in may 2013 indianas inheritance tax. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. This chapter may be cited as the South Carolina Estate Tax Act.

You should also keep in mind that some of your property wont technically be a part of your estate. Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing and indexing system of liens imposed by the South Carolina Department of Revenue that will take effect on July 1 2019. It is one of the 38 states that does not have either inheritance or estate tax.

South Carolina does not levy an estate or inheritance tax. 8 00 9 TAX on excess withdrawals from Catastrophe Savings Accounts. There is no inheritance tax in South Carolina.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. 7 TAX on Lump Sum Distribution attach SC4972. Make sure to check local laws if youre inheriting something from someone who lives out of state.

This means that if you have 3000000 when you die you will get taxed on the 300000 over the 2700000 exemption. 7 00 8 TAX on Active Trade or Business Income attach I-335. The average property tax rate is now6760 compared to6785 last year a 035 decrease statewide.

Federal exemption for deaths on or after January 1 2023. As an example consider the family from Pennsylvania who. This is your TOTAL SOUTH CAROLINA TAX10 00 30752190 Page 2 of 3 Your SSN _____ 2019.

As well as how to collect life insurance pay on death accounts and survivors benefits and fast South Carolina probate for small estates. For the year 2016 the lifetime exemption amount is 545 million. Note that if you leave everything to your spouse there is no estate.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. Find Out What You Need To Know - See for Yourself Now.

Neither South Carolina nor North Carolina have an inheritance tax but people who live here are sometimes still forced to pay inheritance taxes. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. South Carolina Inheritance Tax and Gift Tax.

North carolina estate tax 2019. This doesnt eliminate other expenses related to estate planning expenses such as inheritance tax that might come from another state or a. You pay inheritance tax as part of your income taxes in the form of inheritance-based.

Clients should seek the advice of a competent attorney to determine whether and how much estate tax liability may be applicable in specific situations. If youre planning an estate or just inherited money its a good idea to work with. South Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. Tax is tied to federal state death tax credit. South Carolina Inheritance Law.

Does South Carolina Have an Inheritance Tax or Estate Tax. This is because the six states that assess an inheritance tax tax the recipient of an inheritance no matter what state he or she is living in. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022.

Maryland imposes the lowest top rate at 10 percent. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates.

Does South Carolina Have an Inheritance Tax or Estate Tax. Even though South Carolina does not collect an inheritance tax however you could end up paying inheritance tax to another state. Minnesota has an estate tax for any assets owned over 2700000 in 2019.

More distant heirs like cousins or nieces and nephews may. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state. The federal gift tax.

See where your state shows up on the board. Has the highest exemption level at 568 million. Unlike some other states there are no inheritance or estate taxes in South Carolina.

Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. We researched it for you. However the federal government still collects these taxes and you must pay them if you are liable.

What are the estate taxes in South Carolina. Ad Federal Inheritance Tax Inheritance Tax Estate Tax Federal Estate Tax. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state.

The rates of tax in Minnesota on amounts over 2700000 are between 13 16. 9 00 10Add line 6 through line 9 and enter the total here. Currently South Carolina does not impose an estate tax but other states do.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. Up to 25 cash back To inherit under South Carolinas intestate succession statutes a person must outlive you by 120 hours. 2 Federal credit means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. There are no inheritance or estate taxes in South Carolina.

In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more. All six states exempt spouses and some fully or partially exempt immediate relatives. In the tax cuts and jobs act the federal.

South Carolina also has no gift tax. The parents inherit according to 62-2-103 2 only if there are no children and no spouse. Massachusetts has the lowest exemption level at 1 million and DC.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

Thinking About Moving These States Have The Lowest Property Taxes

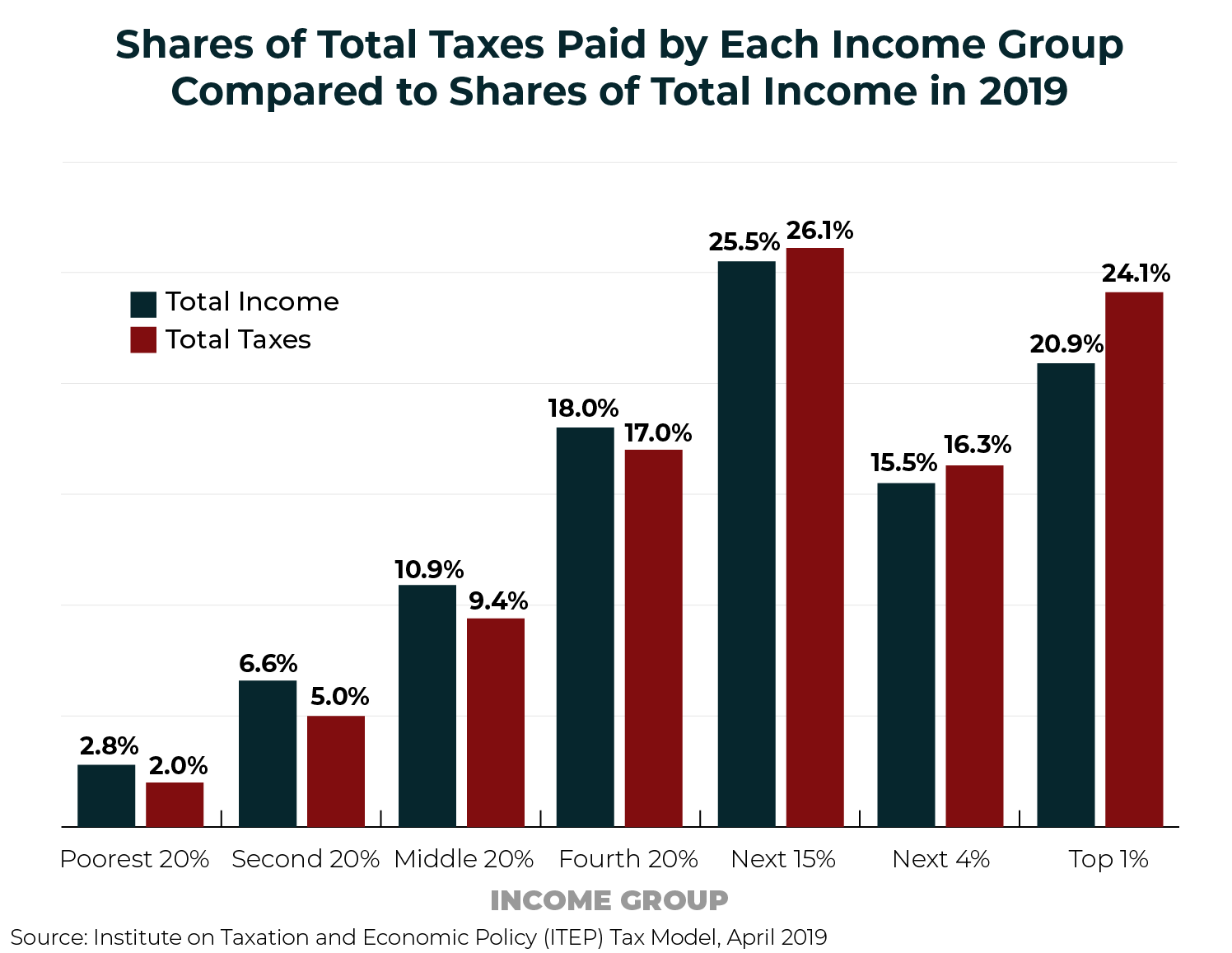

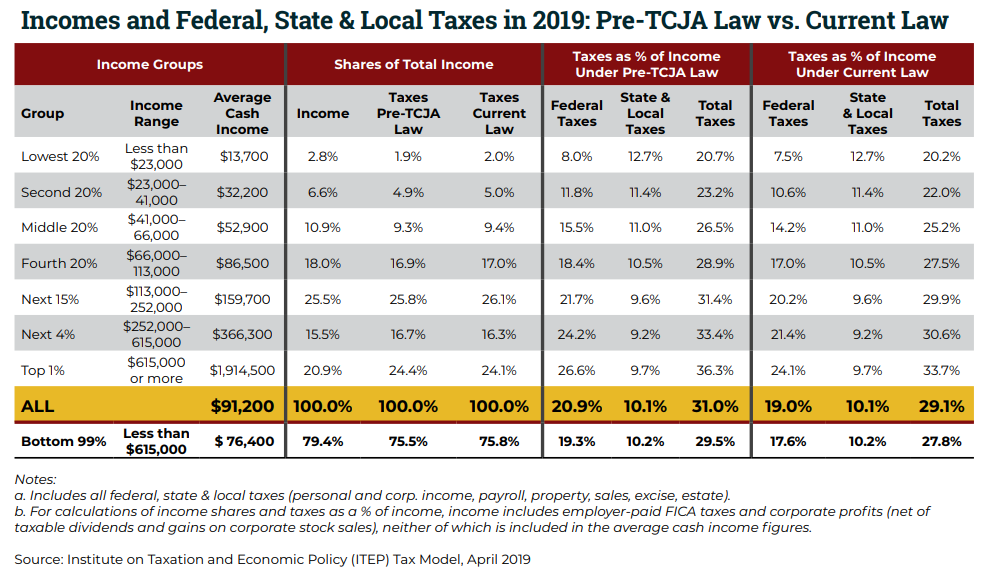

Who Pays Taxes In America In 2019 Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

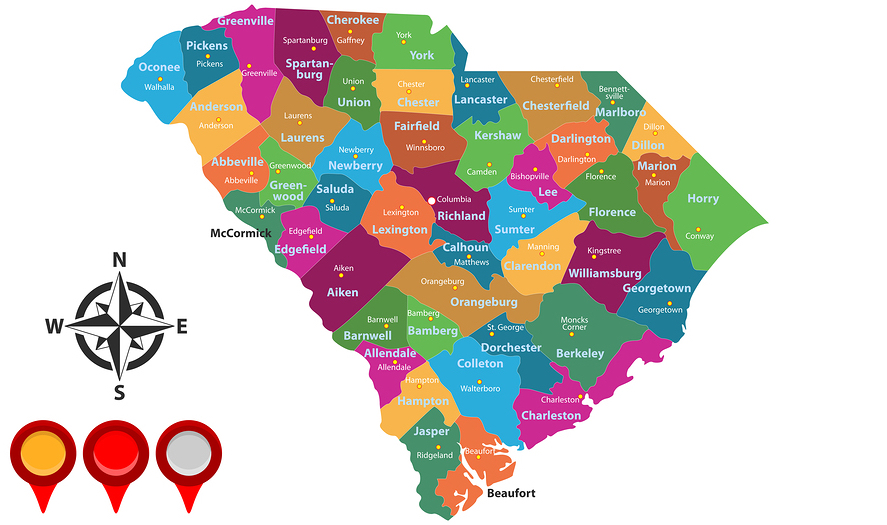

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Who Pays Taxes In America In 2019 Itep

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

South Carolina Inheritance Laws King Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Election 2020 State Health Care Snapshots South Carolina Kff

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)